The Best Finance Apps of 2024

Written by: BestApp.com App Testing Team - Updated: Mar 25, 2022

If you’re looking for an app to help you manage your finances, we recommend Mint for its powerful features that make it easy to create and stick to a budget, track expenses, pay off debts, and more. But if Mint doesn’t work for you, we found nine other great apps for you to check out. Here are the 10 best finance apps available on iOS and Android.

Top 10 Finance Apps to Try

- Mint — Top Pick

- Credit Karma — Best Free Finance App

- Personal Capital — Best for Retirement

- You Need A Budget — Best for Budgeting

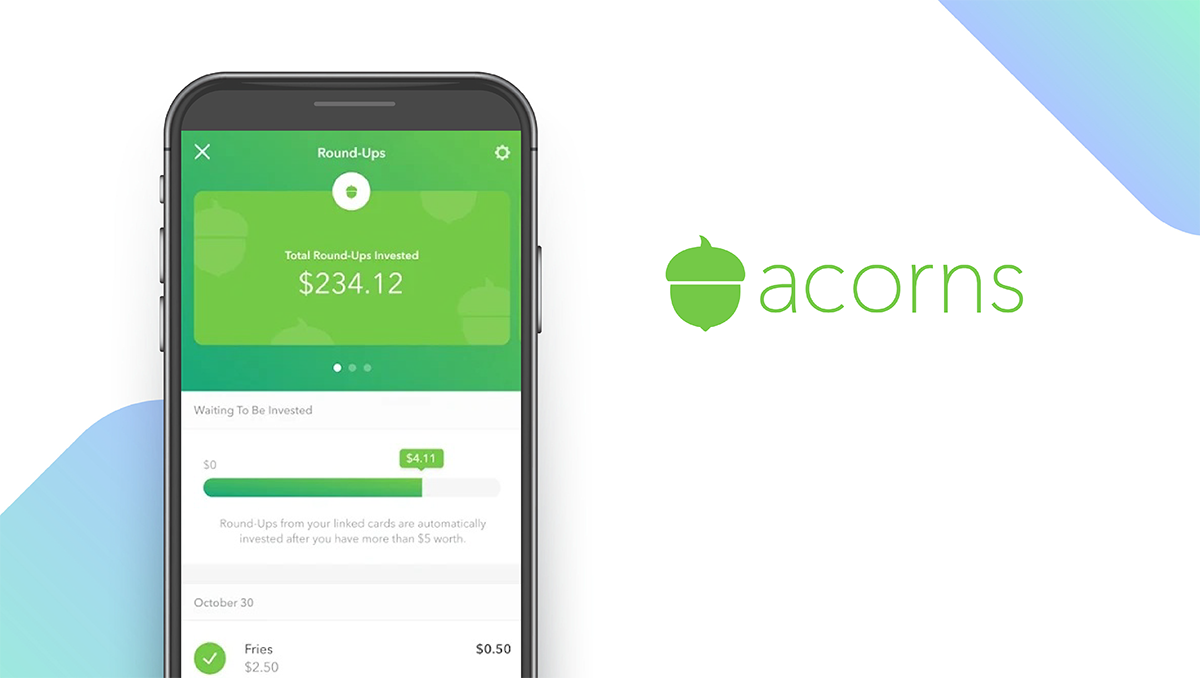

- Acorns — Best for Investing

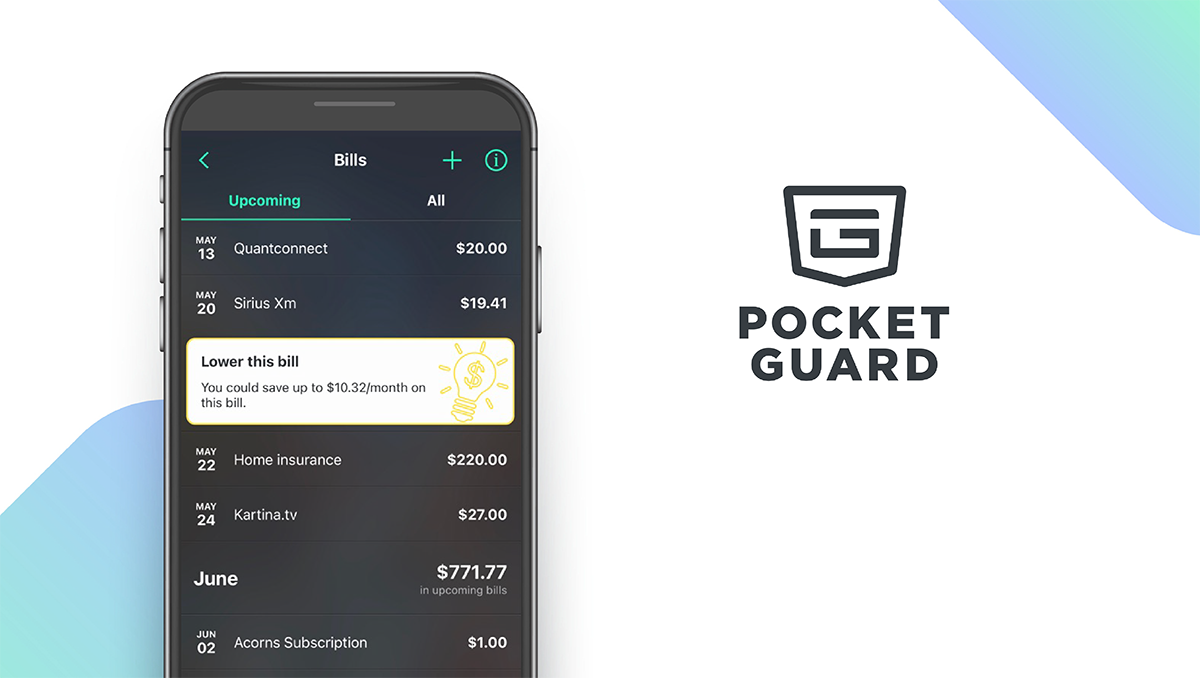

- PocketGuard — Best for Managing Subscriptions

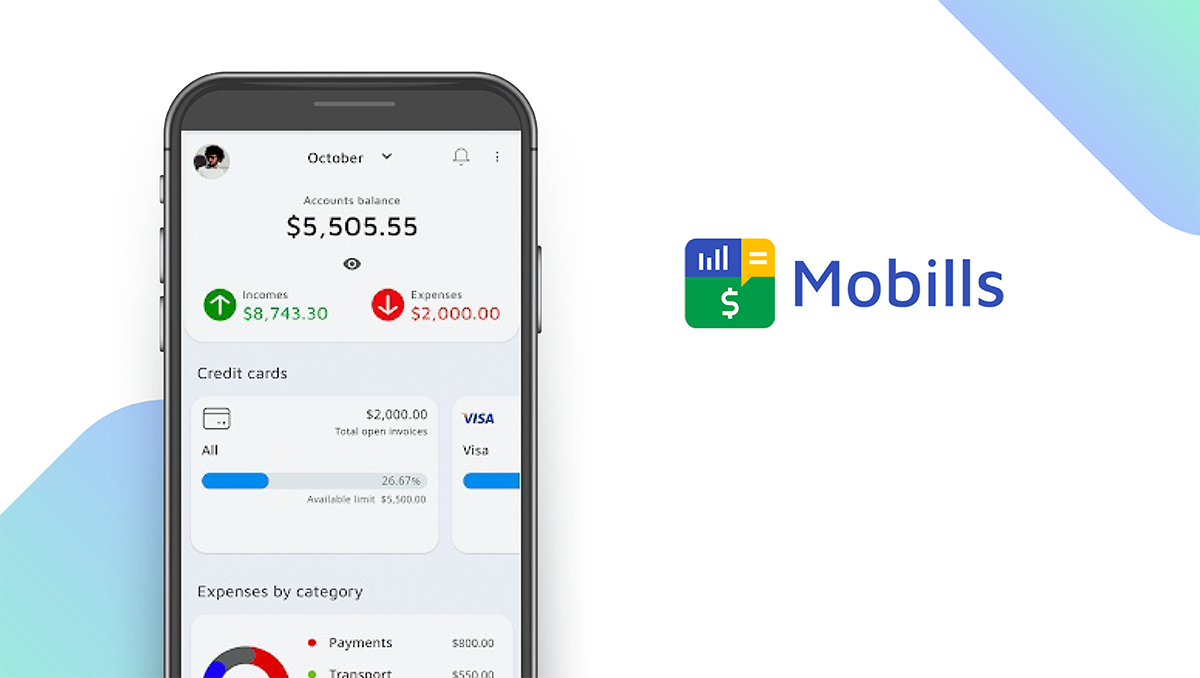

- Mobills — Best for Managing Credit Cards

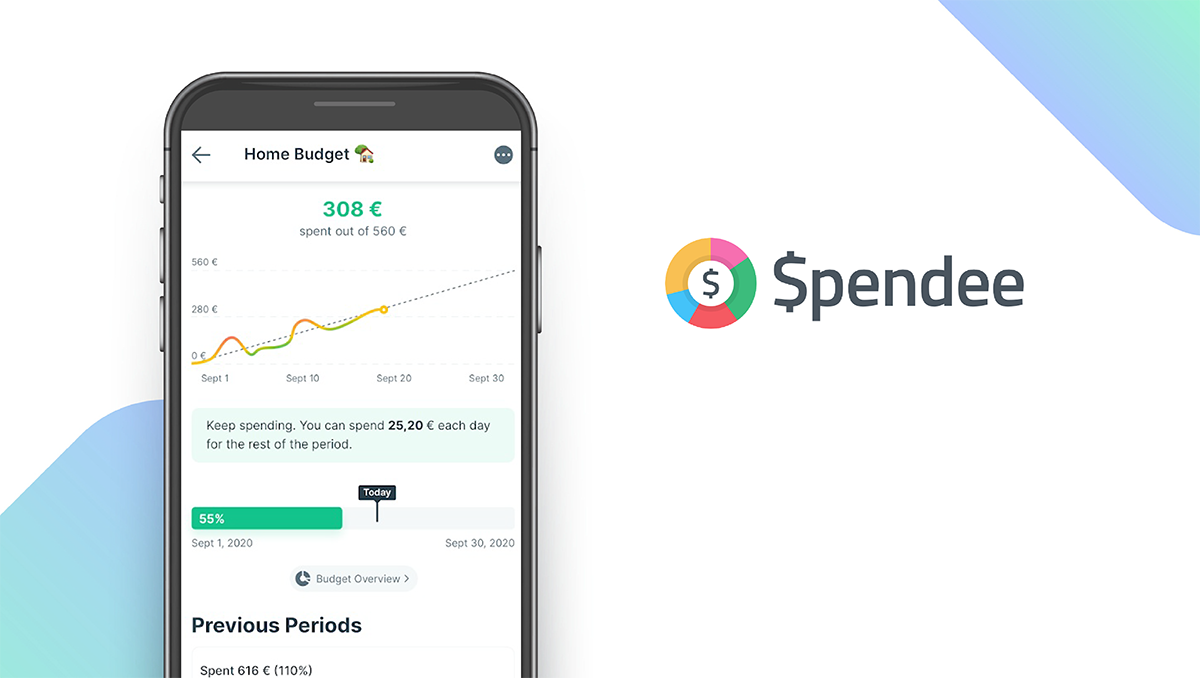

- Spendee — Best for Shared Finances

- EveryDollar — Best for Connecting with Experts

- Goodbudget — Best for Tracking Debt Progress

How We Chose the Best Finance Apps

To choose the 10 best finance apps, we looked for apps that offer the features users need to view, monitor, and manage their financial health and activity. The best finance apps offer expense tracking, credit monitoring, spare change roundups, and cryptocurrency support.

Choose the finance app that’s right for you

Most of the apps on our list offer a free trial or free version for users to get started with. Apps like Mint and You Need A Budget are great for users who need help tracking their expenses and sticking to a budget, while apps like PocketGuard are great for tracking and managing bills and subscriptions. We recommend checking out several apps to find the one that works best for you.

Link your financial accounts

Most of the finance apps on our list give users the option to link their bank accounts, credit cards, and even cryptocurrency wallets to track their balances and transactions. We recommend taking advantage of this feature to make it easier to track your spending and stick to your budget.

Our Finance App Reviews

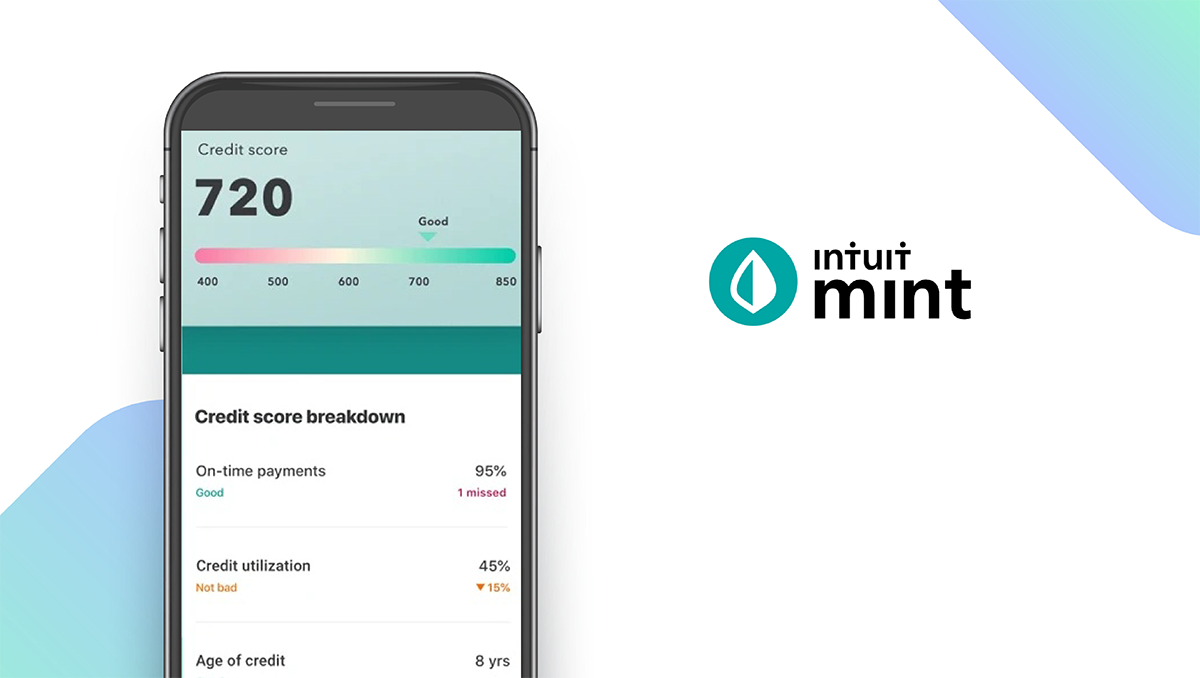

Mint — Top Pick

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

Mint is an all-in-one financial management app that helps users do everything from planning a budget and tracking expenses to paying bills and monitoring credit. Users can link their credit cards and financial accounts to track their balances and debts and even keep tabs on subscriptions in one place. Unlike other apps on our list, TurboTax users can use Mint to track their tax refund (both services are owned by Intuit). You can create and track custom financial goals, view a breakdown of your credit score, find money-saving offers, and use BillShark to negotiate lower monthly bills.

Notable features:

- Free version available

- In-app purchases: $0.99 per item

- Support available: Email, Help Center/FAQs

| Mint Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| Budget planning | Doesn’t round up spare change after purchases |

| Credit monitoring | |

| Personalized financial insights | |

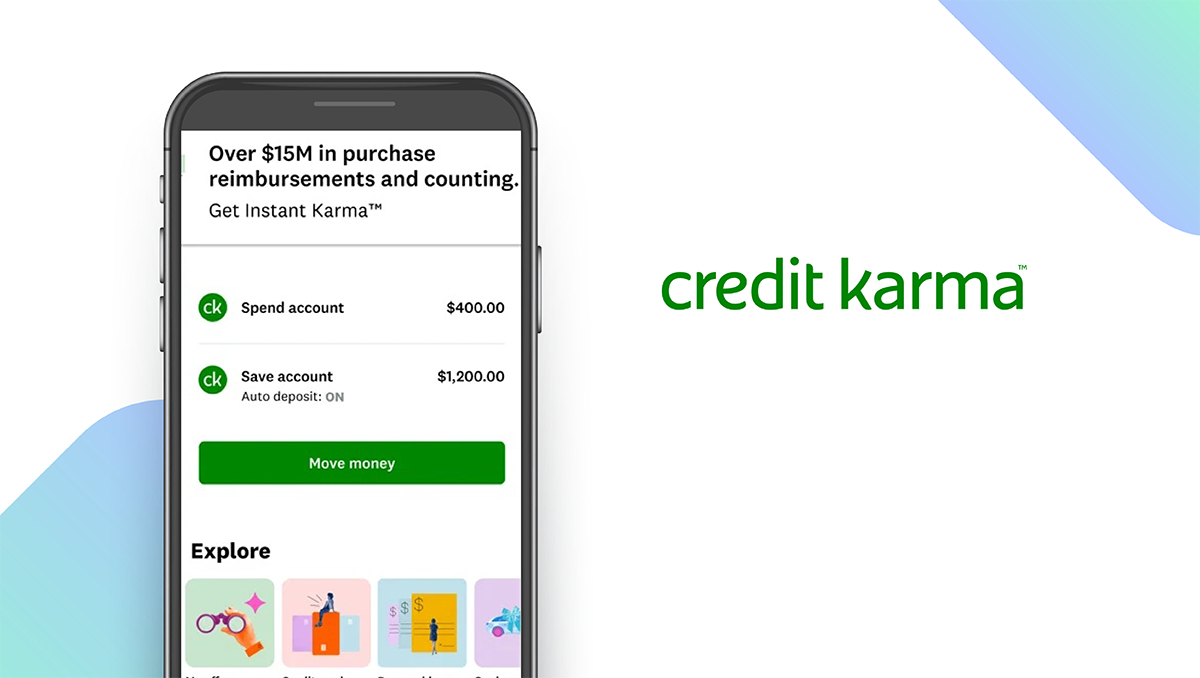

Credit Karma — Best Free Finance App

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

Credit Karma is a completely free finance app that offers a wide range of useful perks and features you won’t find on other apps on our list. This includes the unique Instant Karma feature, which gives users a chance to win instant cash reimbursement for debit card purchases. Unlike similar apps, you can use Credit Karma to apply for credit cards and personal loans as well as find car insurance discounts and home loan offers. Users can sign up for data breach monitoring to protect themselves against identity theft, and the financial relief roadmap can help users in need of financial assistance find programs and resources.

Notable features:

- Free version available

- Subscription plans: None

- Support available: Email, Help Center

| Credit Karma Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| Credit monitoring | No expense tracking |

| Instant Karma for cash reimbursement | Lacks budget planning features |

| Apply for loans and credit cards in-app | |

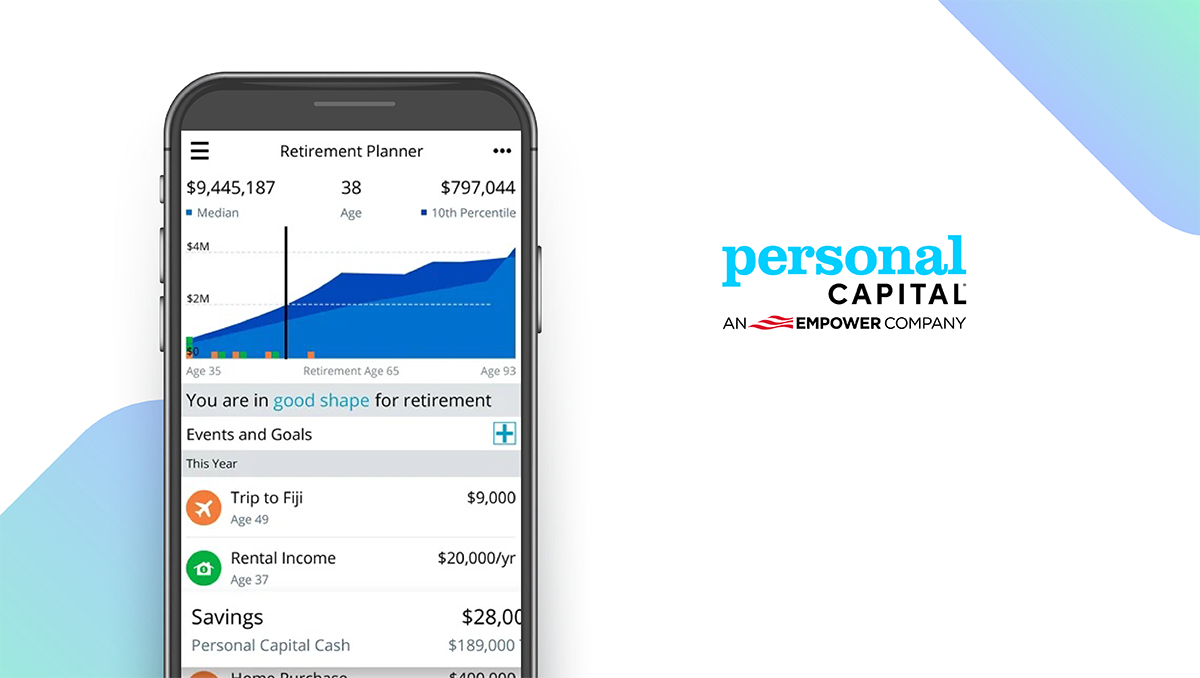

Personal Capital — Best for Retirement

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

Personal Capital is the only app on our list designed specifically to help users plan and track their retirement savings. You can use the app to monitor and track your investments, net worth, and financial accounts. The app analyzes your portfolio to project whether or not you will be able to reach your retirement goals with your current investments. In addition to your investment accounts, you can also use the app to track your debt, personal banking accounts, and more. The interactive cash flow tool lets you see your total income and total expenses across all your accounts, and the Investment Checkup tool makes it easy to analyze how well your investments are performing.

Notable features:

- Free version available

- Subscription plans: None

- Support available: Email, Help Center, FAQs, Ticket

| Personal Capital Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| Retirement planning and forecasting | No credit monitoring |

| Cash flow tracking | No budget planning features |

| Investment tracking | |

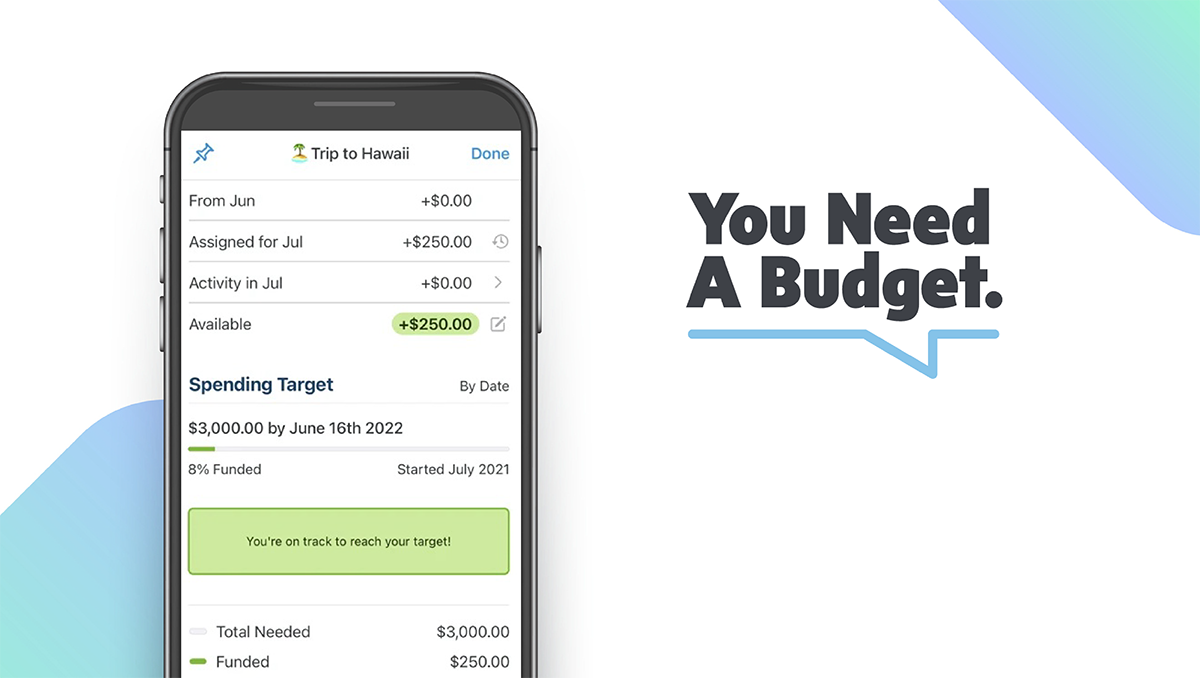

You Need A Budget — Best for Budgeting

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

You Need A Budget (YNAB) is one of the most popular and reputable budget planning apps available on iOS and Android. With YNAB, users can set and track financial goals, assign the money they earn to specific categories, import transactions from their financial accounts, and track expenses in real-time. The app includes a unique loan calculator tool to help you calculate interest on loans and pay off your debts. You can gain insights into your finances via the app’s spending and net worth reports, and you can link your bank accounts to view all your finances in one place.

Notable features:

- Free trial available

- Subscription plans: $14.99/month

- Support available: Email, Help Center

| You Need A Budget Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| Advanced budget planning features | No free plan |

| Built-in loan calculator | |

| Real-time expense tracking | |

Acorns — Best for Investing

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

Acorns is a unique finance app that helps users build up their savings by investing their spare change. The app’s unique Round-Ups feature invests your spare change every time you make a purchase, and you can earn bonus investments when you shop at over 12,000 brands using the app or browser extension. Acorns can also help you set up a retirement account, and Acorns Early lets you set up an investment account for your kids. By creating an Acorns checking account, you can invest with real-time Round-Ups, automatically invest a portion of every paycheck with Smart Deposit, and get paid up to two days early with direct deposit.

Notable features:

- Free version not available

- Subscription plans: Personal: $3/month; Family: $5/month

- Support available: Email, Help Center

| Acorns Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| Rounds up spare change for investing | No free plan |

| Bonus investments and rewards | No budget planning features |

| Retirement planning | |

PocketGuard — Best for Managing Subscriptions

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

PocketGuard is a comprehensive finance app that offers budget planning, bill organizing, and subscription management. This app lets you link your accounts to track your spending, view all your balances in one place, and create a monthly budget. They crunch the numbers to show how much spendable money you have after setting aside enough for bills, goals, and necessities. It is easy to learn more about your habits with customized spending reports and insights. One of the app’s most unique features is the ability to view and manage all your subscriptions in one place. When you want to cancel a subscription, you can do so through PocketGuard without visiting a separate website. You can also view all your upcoming bills, and PocketGuard will notify you when you may be able to save on specific monthly bills.

Notable features:

- Free version available

- Subscription plans: PocketGuard Plus: $4.99/month

- Support available: Email, Help Center/FAQs

| PocketGuard Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| Subscription management | No cryptocurrency support |

| Budget planning | No credit scores |

| Bill organizing | |

Mobills — Best for Managing Credit Cards

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

Mobills is a budget planner and bill organizer that allows you to create a monthly budget, track your spending, and set financial goals. You start by defining financial goals (e.g., getting out of debt, saving for retirement), and the app will help you create a budget that reflects your goals. You can view graphs and reports to gain financial insights and learn more about your spending habits. Mobills stands out from other finance apps thanks to its credit card management features, which allow users to track their credit card balances and credit limits, as well as get bill payment reminders.

Notable features:

- Free version available

- Subscription plans: Pro: $49.99/year

- Support available: Email, Help Center, Ticket

| Mobills Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| Credit card management | No cryptocurrency support |

| Expense tracking | No spare change roundups |

| Budget planning | |

Spendee — Best for Shared Finances

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

Spendee is a budget planner and money tracker that makes it easy for users to track their spending habits and maintain a responsible budget. You can connect your bank accounts to view all your finances in one place, and unlike other apps, Spendee also lets you link your cryptocurrency wallets. Charts and reports let you learn more about your spending habits, and personal insights help you learn how to spend your money more responsibly. Spendee also stands out thanks to its features that help users manage shared financial accounts, making it a great option for couples.

Notable features:

- Free version available

- Subscription plans: Premium: $2.99/month; Plus: $1.99/month

- Support available: Email, Help Center

| Spendee Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| Manage shared finances | Lacks credit monitoring features |

| Link cryptocurrency wallets | |

| Expense tracking | |

EveryDollar — Best for Connecting with Experts

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

EveryDollar is a feature-rich budget planning app with all the tools users need to take complete control of their finances. You can build a budget that suits your needs, track your spending, create custom spending categories, set up savings funds, and more. Unlike any other app on our list, EveryDollar also helps users find and connect with local finance professionals to help manage finances, apply for loans, and more. You can set up bill payment reminders and add receipts, and with a Premium subscription you can access additional features like bank account syncing, priority support, personalized financial reports, and automatic balance updates.

Notable features:

- Free version available

- Subscription plans: Premium: 3 Months: $59.99; 6 Months: $99.99; 12 Months: $129.99

- Support available: Email, Help Center, Ticket

| EveryDollar Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| Budget planning | Bank account syncing requires Premium |

| Connect with local finance professionals | No credit monitoring features |

| Expense tracking | |

Goodbudget — Best for Tracking Debt Progress

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

Goodbudget is a personal finance app that helps users create budgets, track their spending, analyze their financial health, and keep track of their debt progress. Users can create envelopes for different categories, including groceries, gas, dining out, and more. You can view your spending habits through detailed charts and graphs, and unlike other finance apps, you can easily share your budgets with your spouse, family members, or friends. Goodbudget also stands out thanks to its debt tracking features, which make it easy to view your balances, track your payments, and forecast when your debt will be paid off.

Notable features:

- Free version available

- Subscription plans: Plus: $8/month

- Support available: Email, Phone, Help Center, Forum

| Goodbudget Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| Debt tracking | Lacks cryptocurrency support |

| Share budgets with other users | |

| Budget planning | |

Finance Apps: Features Summary Table

| Finance Apps Comparison Table | ||

|---|---|---|

| App | Subscription Fees or In-App Purchases | Features |

| Mint — Top Pick | $0.99 per item | X Spare Change Roundup ✓ Expense Tracking ✓ Credit Monitoring ✓ Cryptocurrency |

| Credit Karma — Best Free Finance App | None | X Spare Change Roundup X Expense Tracking ✓ Credit Monitoring X Cryptocurrency |

| Personal Capital — Best for Retirement | None | X Spare Change Roundup ✓ Expense Tracking X Credit Monitoring ✓ Cryptocurrency |

| You Need A Budget — Best for Budgeting | $14.99/month | X Spare Change Roundup ✓ Expense Tracking ✓ Credit Monitoring X Cryptocurrency |

| Acorns — Best for Investing | Personal: $3/month Family: $5/month |

✓ Spare Change Roundup X Expense Tracking X Credit Monitoring X Cryptocurrency |

| PocketGuard — Best for Managing Subscriptions | PocketGuard Plus: $4.99/month | X Spare Change Roundup ✓ Expense Tracking ✓ Credit Monitoring X Cryptocurrency |

| Mobills — Best for Managing Credit Cards | Pro: $49.99/year | X Spare Change Roundup ✓ Expense Tracking ✓ Credit Monitoring X Cryptocurrency |

| Spendee — Best for Shared Finances | Premium: $2.99/month Plus: $1.99/month |

X Spare Change Roundup ✓ Expense Tracking X Credit Monitoring ✓ Cryptocurrency |

| EveryDollar — Best for Connecting with Experts | Premium: 3 Months: $59.99 6 Months: $99.99 12 Months: $129.99 |

X Spare Change Roundup ✓ Expense Tracking X Credit Monitoring X Cryptocurrency |

| Goodbudget — Best for Tracking Debt Progress | Plus: $8/month | X Spare Change Roundup ✓ Expense Tracking ✓ Credit Monitoring X Cryptocurrency |