The Best Money-Saving Apps of 2025

Written by: BestApp.com App Testing Team - Updated: Jul 31, 2021

We selected Acorns as the best money-saving app because it offers many investment options and security features. While Acorns should be the best solution for most people, some users will find that other apps are better for addressing their specific needs. We have also reviewed nine other top money-saving apps that you should check out below.

Top 10 Money-Saving Apps to Try

- Acorns — Top Pick

- Qapital — Most Advanced Saving Technology

- Chime Banking — Best Banking Features

- Digit — Best for Paying Off Debt

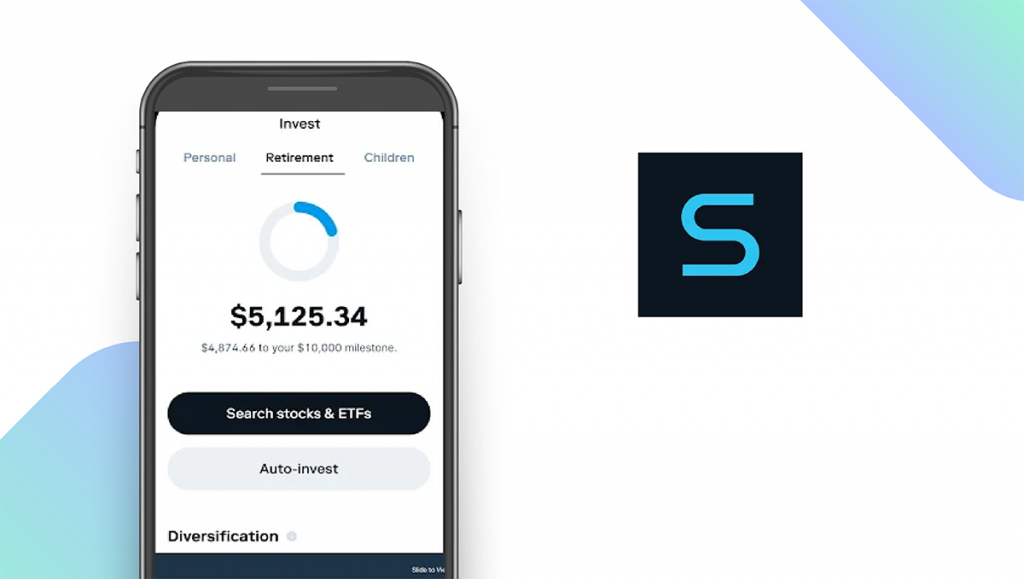

- Stash — Most Popular

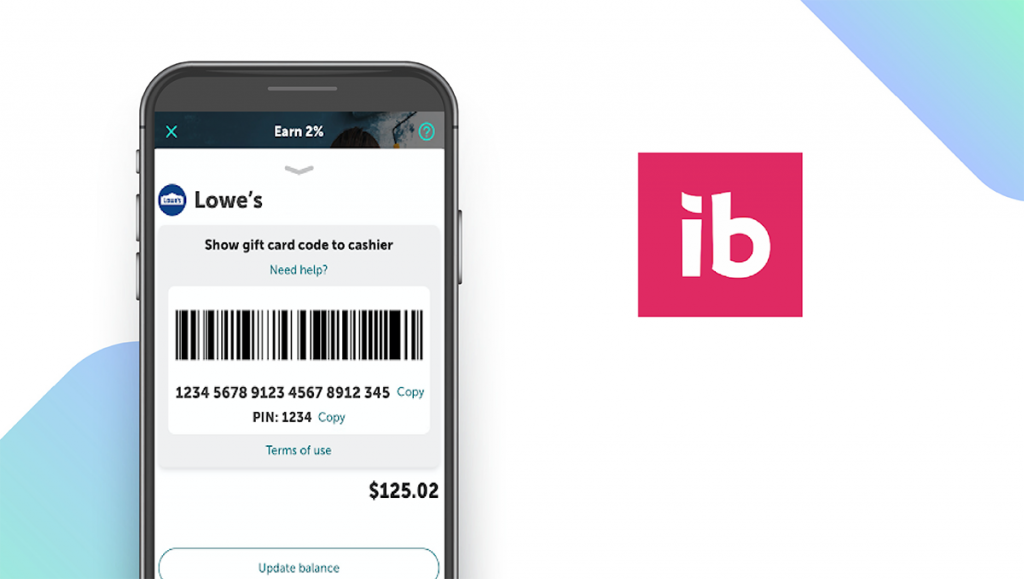

- Ibotta — Best for Cash Back Rewards

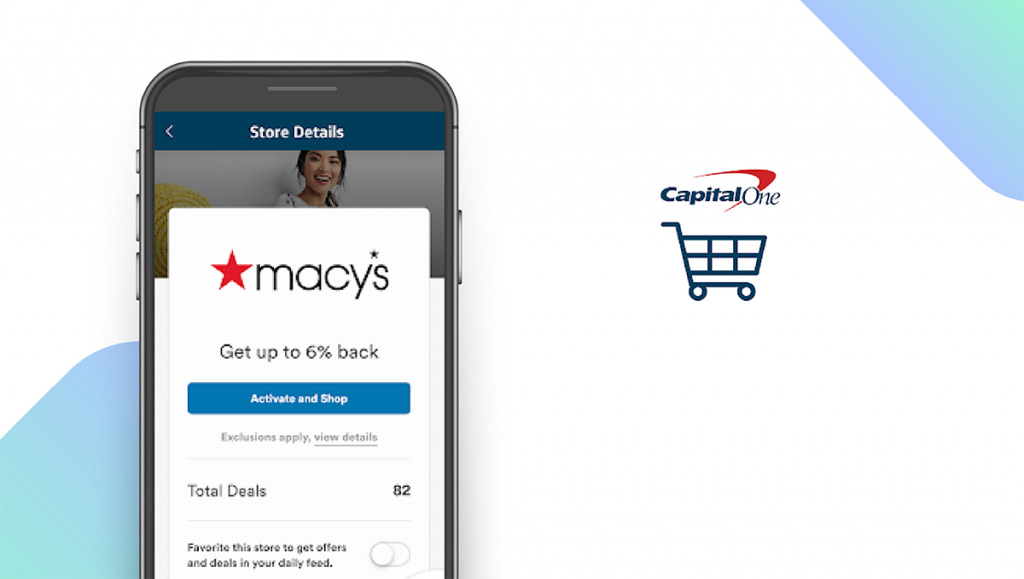

- Capital One Shopping — Best for Coupons

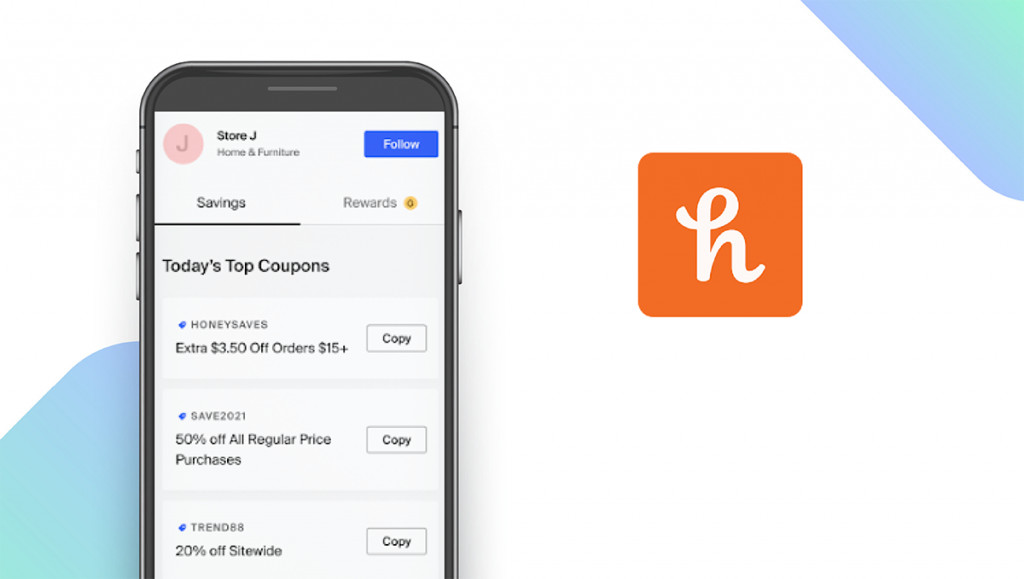

- Honey — Most User-Friendly Interface

- Shopkick — Best for In-Store Shopping

- Twine — Best for Couples

How We Chose the Best Money-Saving Apps

When determining the best money-saving apps, we looked for features such as investing, mobile payments, and cashback rewards. We included providers that offer affordable pricing and multiple channels you can contact for support.

Choose the money-saving app that’s right for you

The best money-saving app for one user may not be the best for another, as people often have different financial goals. For example, you may be interested in using the stock market to make the most of your savings, or you might be more concerned about analyzing your budget and identifying ways to cut down on your spending.

Turning spare change into big savings

One of the most popular features for money-saving apps is rounding up your purchases to the next dollar, then allowing you to save or invest this spare change. This is one of the most effective ways to build up savings while sticking to a realistic budget, so we made sure to include several apps that offer this feature.

Our Money-Saving App Reviews

Acorns — Top Pick

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

Acorns makes it easy to save more money. You can use this app to automatically round up your purchases and invest your spare change in one of their diversified ETF portfolios. Acorns also gives you the option to set up a retirement plan or an investment account for kids. You can be confident your financial data is protected, as Acorns offers bank-level security and encryption.

Notable features:

- No free trial

- Acorns Lite: $1/month, Acorns Personal: $3/month, Acorns Family: $5/month

- Support available: FAQs, Tickets

| Acorns Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| Variety of saving features | No free version is available |

| Strong security | |

Qapital — Most Advanced Saving Technology

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

Want to build up some savings in case of an emergency? With Qapital’s personalized goals and automated saving rules, you can do so without even thinking about it. This app’s advanced technology is based on behavioral economic principles. It can help you design the optimal weekly budget for your situation and make the most of your income. Qapital is especially useful for couples, as it allows you to save toward shared goals and see each other’s transactions without giving up your account.

Notable features:

- 30-day free trial

- Basic: $3/month, Complete: $6/month, Master: $12/month

- Support available: Help Center, Live Chat, Email

| Qapital Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| Collaboration tools | No free version is available |

| Live support | |

Chime Banking — Best Banking Features

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

Chime can certainly help you save up, as it offers features for saving money automatically as you send or receive payments. What sets Chime apart from the other apps covered in this guide is a full suite of banking features, there are no monthly fees or overdraft fees, and there’s no minimum balance required. You’ll also get access to a network of 38,000 fee-free ATMs, and you can get paid up to two days early with a direct deposit.

Notable features:

- Free mobile app

- Support available: Help Center, Email, Phone

| Chime Banking Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| Complete banking solution | Limited saving features |

| All features included for free | |

Digit — Best for Paying Off Debt

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

In addition to building up your savings, you may also be interested in paying down debt. In that case, you should strongly consider Digit, as this app has been used to pay off over $180 million in debt collectively. Digit analyzes your spending patterns and income, and then it will help you save what you can afford and pay off your debts faster. You can also set up this app to automatically move money back into your checking account whenever needed to avoid overdraft fees.

Notable features:

- 30-day free trial

- $5/month

- Support available: Help Center, Email, Tickets, FAQs

| Digit Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| Tools for paying down debt | No free version is available |

| Overdraft protection | |

Stash — Most Popular

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

With over five million installs from Google Play alone, Stash is one of the most popular money-saving apps. ITt’s easy to see why this app is so popular as Stash allows you to save for retirement, set up children’s investment accounts, and get personalized financial advice. Their Stock-Back card lets you earn stock in well-known brands such as Netflix, Tesla, and Amazon while you shop.

Notable features:

- 14-Day Free Trial

- Stash Beginner: $1/month, Stash Growth: $3/month, Stash+: $9/month

- Support available: FAQs, Email

| Stash Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| Variety of saving features | No free version is available |

| Earn stock while you shop | |

Ibotta — Best for Cash Back Rewards

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

Ibotta offers cash-back opportunities with thousands of top brands and retailers, including Best Buy, Safeway, eBay, and much more. Overall, this app has saved its users over $500 million. It’s completely free to use, and you’ll get an immediate $20 bonus credit just for signing up. Also, it’s easy to transfer your cash-back rewards from Ibotta directly to a gift card, bank account, or PayPal account.

Notable features:

- Free mobile app

- Support available: Help Center, Tickets

| Ibotta Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| All features are free to use | No live support |

| Variety of cash-back opportunities | |

Capital One Shopping — Best for Coupons

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

If you don’t have a Capital One account, you can still use their shopping app. Consider doing so, as it offers exclusive deals with major retailers such as Amazon, Target, Walmart, and Costco. You can also earn rewards and redeem them for gift cards, and Capital One Shopping makes it easy to find the latest coupon codes that are available at your favorite stores.

Notable features:

- Free mobile app

- Support available: Help Center, Email

| Capital One Shopping Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| All features are free to use | No live support |

| Coupon finding tool | |

Honey — Most User-Friendly Interface

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

Like several apps covered in this guide, Honey can help you save money by connecting you to discounts and other deals. What separates this app from the rest of the pack is the ease of use. Conveniently, it allows you to shop from tons of stores in one place. Coupons can be applied with just one click, or all you need to do is copy and paste the coupon code to unlock your savings.

Notable features:

- Free mobile app

- Support available: Help Center, Email

| Honey Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| All features are free to use | No live support |

| Intuitive interface | |

Shopkick — Best for In-Store Shopping

Download: Android ★★★★★★★★★★ | iOS ★★★★★★★★★★

E-commerce has become popular in recent years, but you likely still do at least some of your shopping at physical stores. Shopkick is a useful money-saving tool for those in-store shopping trips, as you can earn reward points, referred to in the app as “kicks”, by scanning barcodes, scanning receipts, and even just walking through the entrance of certain stores. You can earn kicks with your online purchases as well, and by watching videos.

Notable features:

- Free mobile app

- Support available: FAQs, Tickets, Email

| Shopkick Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| All features are free to use | No live support |

| Variety of ways to earn rewards | |

Twine — Best for Couples

Twine stands out as another app that is excellent for couples who are saving toward a shared goal. Here’s how it works, pick a goal, like saving for a wedding, a house, retirement, etc., connect your bank accounts, and start saving. Twine allows you to track your progress, and the app can provide you with personalized recommendations that will help you reach your financial goals. It also provides bank-level security to ensure that your sensitive financial data is kept private.

Notable features:

- Free mobile app

- Support available: FAQs, Email, Phone, Support Articles

| Twine Pros & Cons | |

|---|---|

| What we like | What we don’t like |

| All features included for free | Not available for Android devices |

| Collaboration tools | |

Money-Saving Apps: Feature Summary Table

| Money-Saving Apps Comparison Table | ||

|---|---|---|

| App | Subscription Fees or In-App Purchases | Features |

| Acorns — Top Pick | Acorns Lite: $1/month, Acorns Personal: $3/month, Acorns Family: $5/month |

X Mobile Payments ✓ Rewards/Cash Back X Deal Finder ✓ Investing |

| Qapital — Most Advanced Saving Technology | Basic: $3/month, Complete: $6/month, Master: $12/month |

✓ Mobile Payments ✓ Rewards/Cash Back X Deal Finder ✓ Investing |

| Chime Banking — Best Banking Features | Free | ✓ Mobile Payments ✓ Rewards/Cash Back X Deal Finder X Investing |

| Digit — Best for Paying Off Debt | $5/month | X Mobile Payments ✓ Rewards/Cash Back X Deal Finder ✓ Investing |

| Stash — Most Popular | Stash Beginner: $1/month, Stash Growth: $3/month, Stash+: $9/month |

✓ Mobile Payments ✓ Rewards/Cash Back X Deal Finder ✓ Investing |

| Ibotta — Best for Cash Back Rewards | Free | ✓ Mobile Payments ✓ Rewards/Cash Back ✓ Deal Finder X Investing |

| Capital One Shopping — Best for Coupons | Free | ✓ Mobile Payments ✓ Rewards/Cash Back ✓ Deal Finder X Investing |

| Honey — Most User-Friendly Interface | Free | ✓ Mobile Payments ✓ Rewards/Cash Back ✓ Deal Finder X Investing |

| Shopkick — Best for In-Store Shopping | Free | X Mobile Payments ✓ Rewards/Cash Back ✓ Deal Finder X Investing |

| Twine — Best for Couples | Free | X Mobile Payments ✓ Rewards/Cash Back X Deal Finder ✓ Investing |